Divorce has always been a mixed bag of the good bad and the ugly, one of divorces truisms is that divorce is not only expensive but also in the process of dividing funds you both in many ways end up worse off at least initially. Credit scores can be effected, especially if one or other spouse is unable to pay off their debts, or misses payments during what can be long divorce proceedings.

As with many things in going through divorce, changes need to happen, and restoration in many areas needs to occur to leap forward and look ahead and not look back. Personal Credit is one of the casualties in many divorces. Financial stress and challenges many times are the nucleus of a divorce and both sides suffer greatly. Fortunately, like divorce, challenged credit does not mean the end, it is also an opportunity for a new clean and fresh beginning.

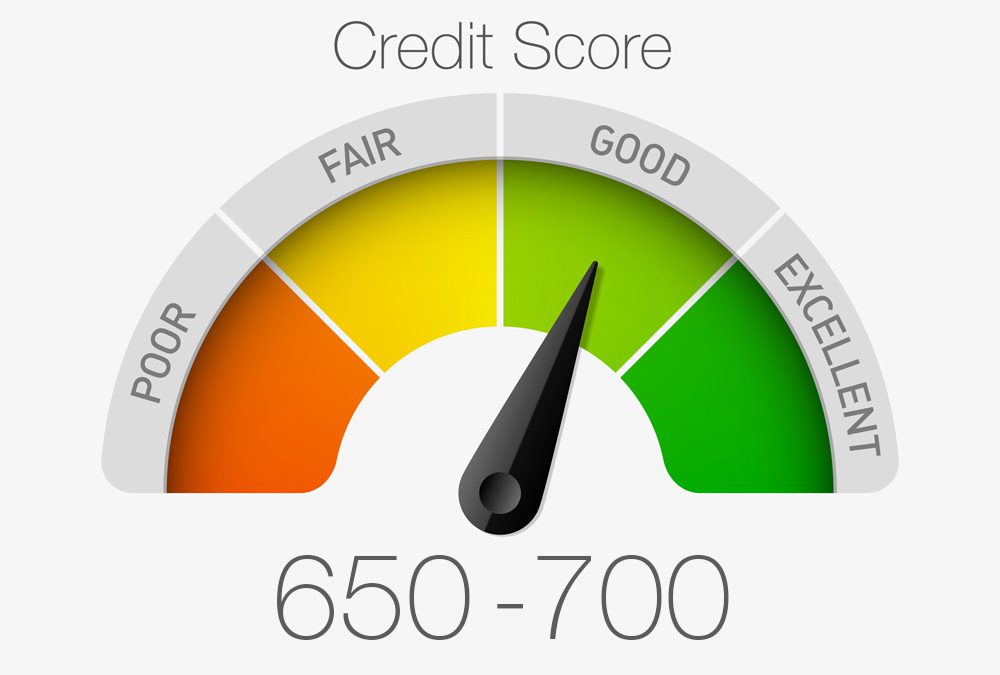

Credit Restoration allows you to deal with the past and prepare for the future. It allows you to address and repair old challenges, such as collection accounts, late payments, tax liens and even bankruptcies in some cases. It also allows you to set a game plan to add positive trade lines, protect your identity and begin improving your credit scores immediately with a time-tested proven system. Seeing an improvement of 75, 100 and even 200 points on your credit scores in a period of time shorter than expected, is not heard of.

Just as you have changed your marital status, you can also change your credit status and move forward in life to have the things you wish and deserve to have. This is especially helpful to anyone whose credit has been damaged by the other spouses during marriage or after divorce. Freeing yourself of them in marriage also means you are free from their credit once all financial ties have been severed.

Gary J Bras

President

(713) 360-4643

.png)